By Sandy Baum

Student Debt: The Unique Circumstances of African American Students

Discussions of student debt frequently treat borrowing for college as a general problem. As a result, they pay inadequate attention to the sharp differences in borrowing and repayment patterns across demographic groups. The data presented in this report show that African American students face unique difficulties. Addressing these difficulties is critical to ensuring access to meaningful educational opportunities for all who can benefit.

African American students are more likely to borrow than students from other racial and ethnic groups pursuing similar types of degrees, and are more likely to borrow relatively large amounts. They are less successful in repaying their loans and more likely to default. The issues facing this group of students are obscured by discussions that paint student debt with a broad brush. Racial differences in pre-college circumstances, in the types of institutions attended, and in post-college earnings all contribute to the difficulties African American students face in college and beyond.

Understanding which borrowers are most vulnerable is an important first step in overcoming the barriers some students face in converting postsecondary enrollment to meaningful opportunities that will improve their lives and their communities. Efforts to mitigate problems with student debt should be grounded in the dramatically different circumstances of students from different backgrounds, and the range of difficulties they face financing higher education.

Debt Levels

The general idea of students “drowning in debt” is greatly exaggerated. But some students do have unmanageable levels of debt, and African American students are particularly likely to be in that situation. The same is not so true for Hispanic students, whose circumstances are often perceived as similar to those of African Americans.

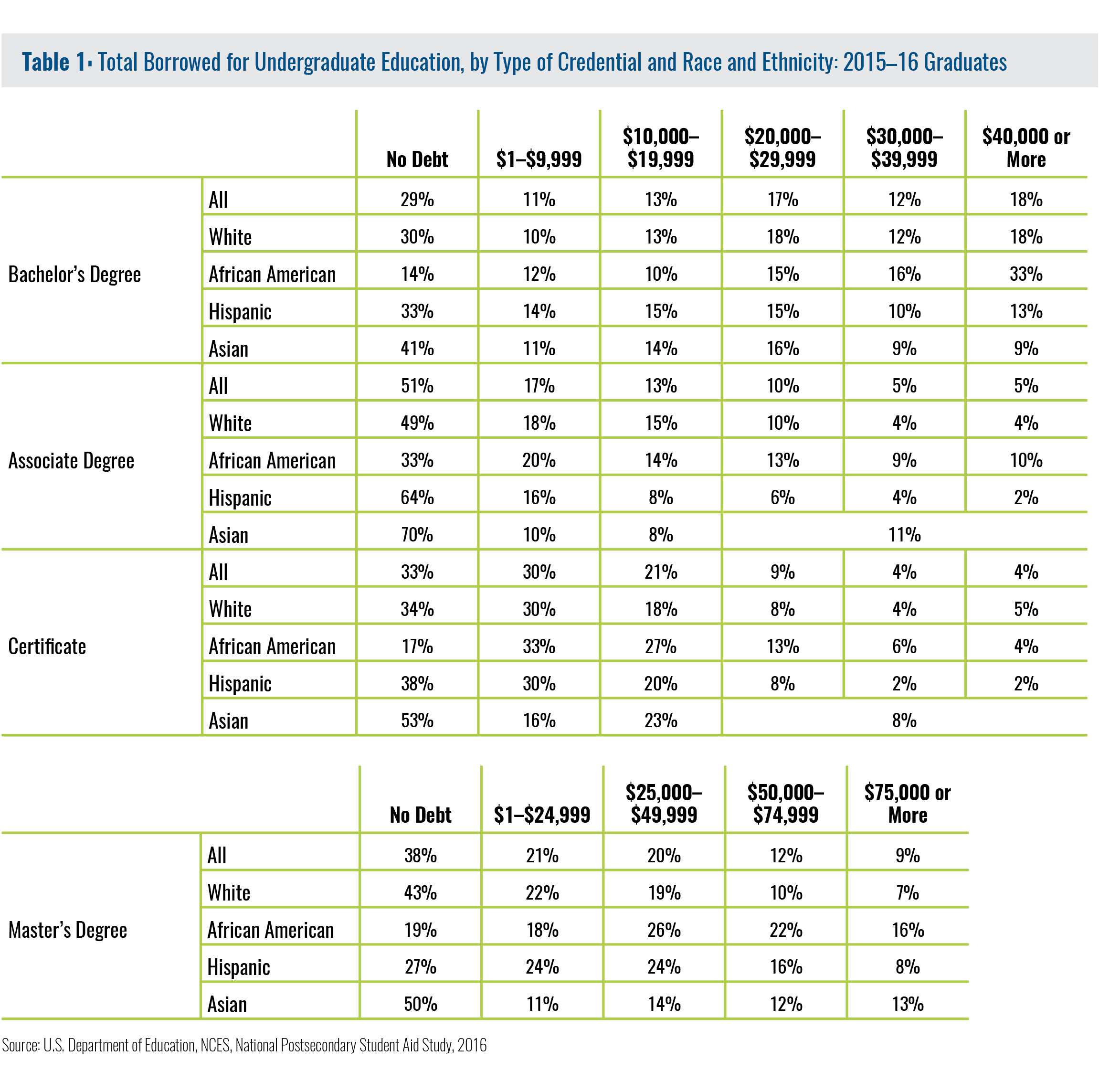

Twenty-nine percent of 2015–16 bachelor’s degree recipients graduated without debt, but only 14 percent of African American graduates managed this. About one-third of African American bachelor’s degree recipients accumulated $40,000 or more in debt, compared with 18 percent overall and 13 percent of Hispanic graduates. The pattern among associate degree and certificate recipients is similar (Table 1).

Only 19 percent of African American master’s degree recipients completed their degrees without borrowing for graduate school, and 16 percent borrowed $75,000 or more. In contrast, 43 percent of white master’s degree recipients avoided borrowing, and 7 percent borrowed $75,000 or more for graduate school.

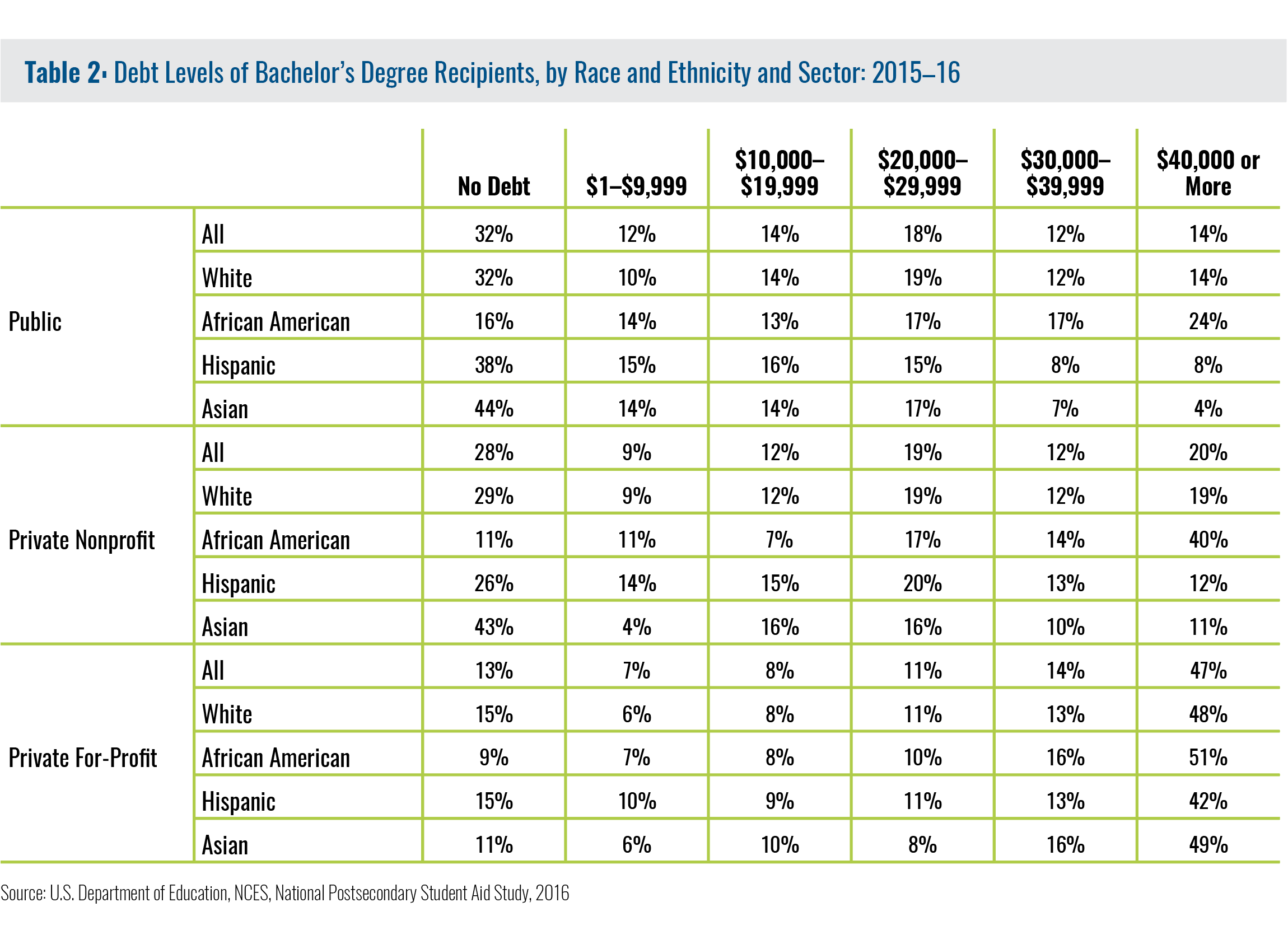

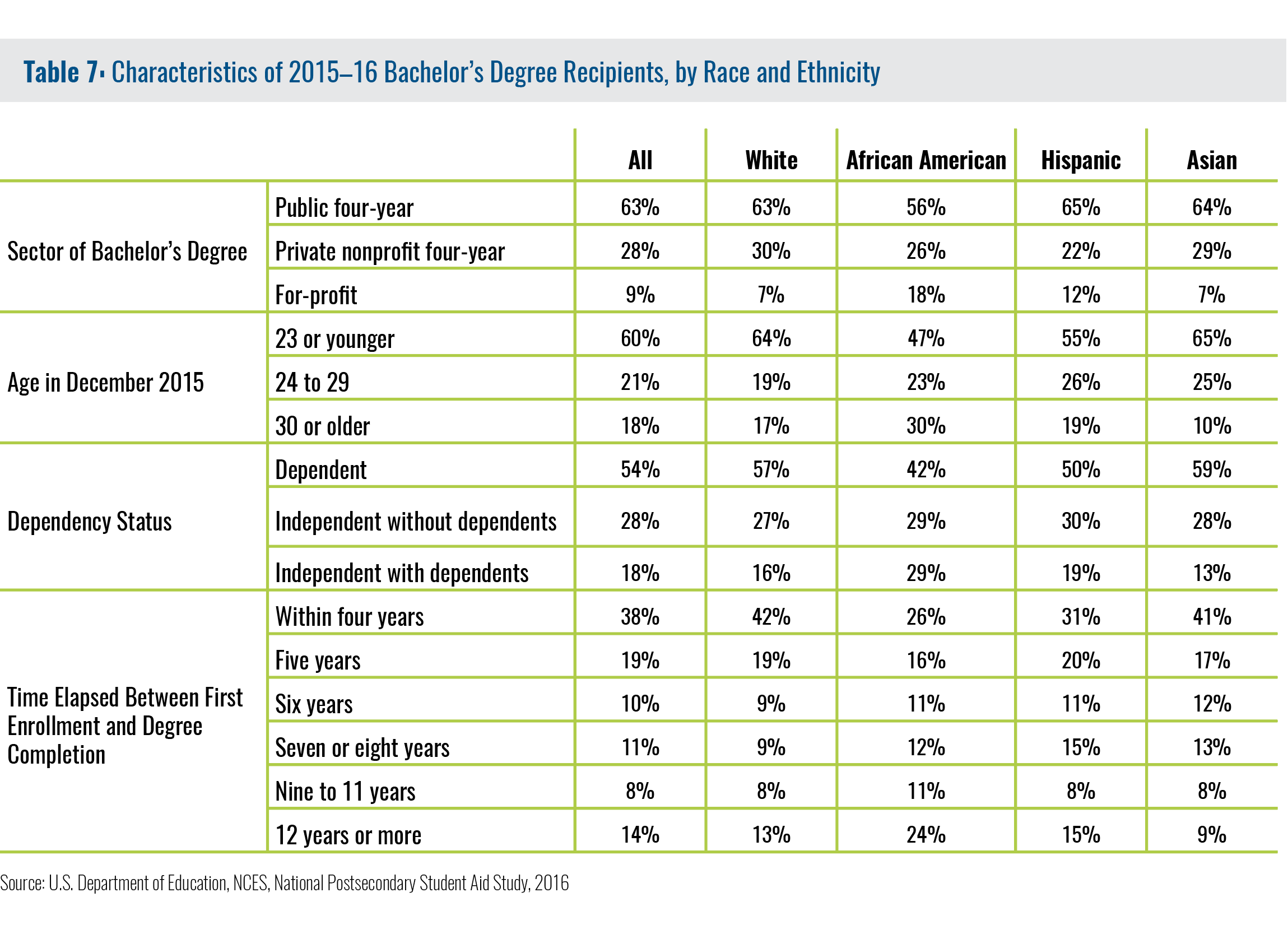

African American students disproportionately enroll in for-profit institutions, where debt levels tend to be highest. For example, 18 percent of 2015–16 African American bachelor’s degree recipients earned their degrees in this sector, compared with 12 percent of Hispanic and 7 percent of white and Asian graduates (see Table 7). But even within sectors, African American students borrow more than others.

Within the public four-year sector, the share of African American graduates borrowing $40,000 or more was almost twice as high as the share of white graduates—24 percent versus 14 percent. Only 8 percent of Hispanic graduates borrowed this much. The differences are starkest in the private nonprofit sector, where 40 percent of African American bachelor’s degree recipients graduated with $40,000 or more in debt, compared with 19 percent of white graduates and smaller shares of His- panic and Asian graduates (Table 2).

This disproportionate borrowing by African American students is likely driven by a combination of problematic societal and historical forces. These forces generate significant gaps across racial and ethnic groups in the availability of financial resources from family income and wealth, K–12 academic preparation, postsecondary enrollment and success patterns, and post-college earnings.

Available Resources

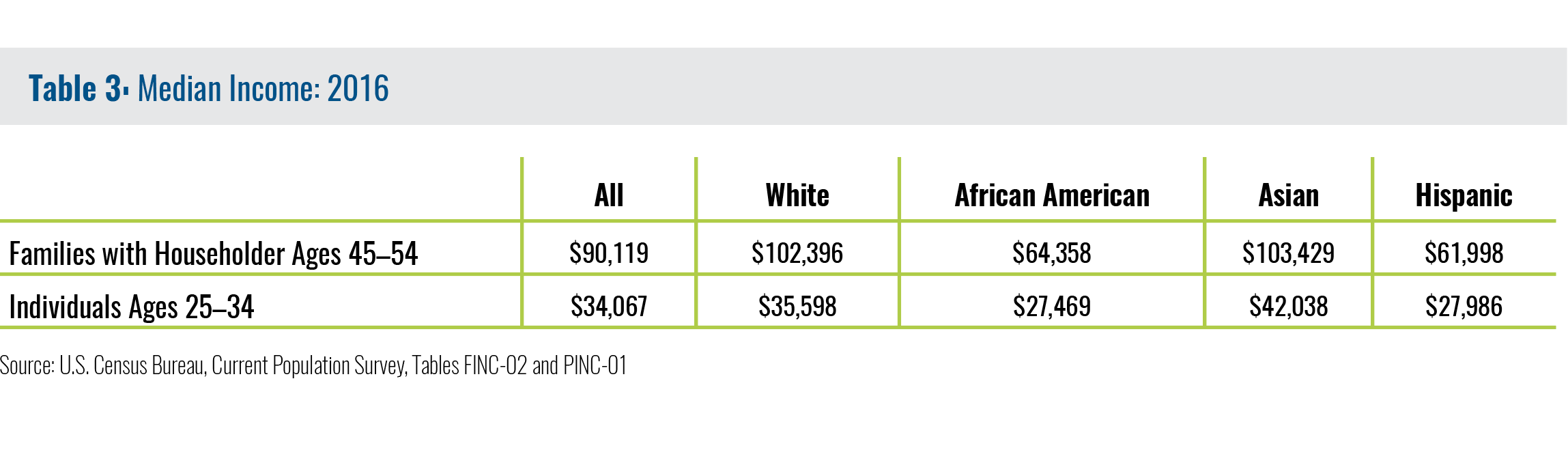

The relatively high levels of debt among African American students are at least partially attributable to the low levels of financial and other resources available to them when they enroll in college. African American parents in the age range when children are typically ready for college have a median income equal to about 70 percent of the overall median. African American adults in the age range when those without a college degree are most likely to return to school earn about 80 percent of the overall median (Table 3).

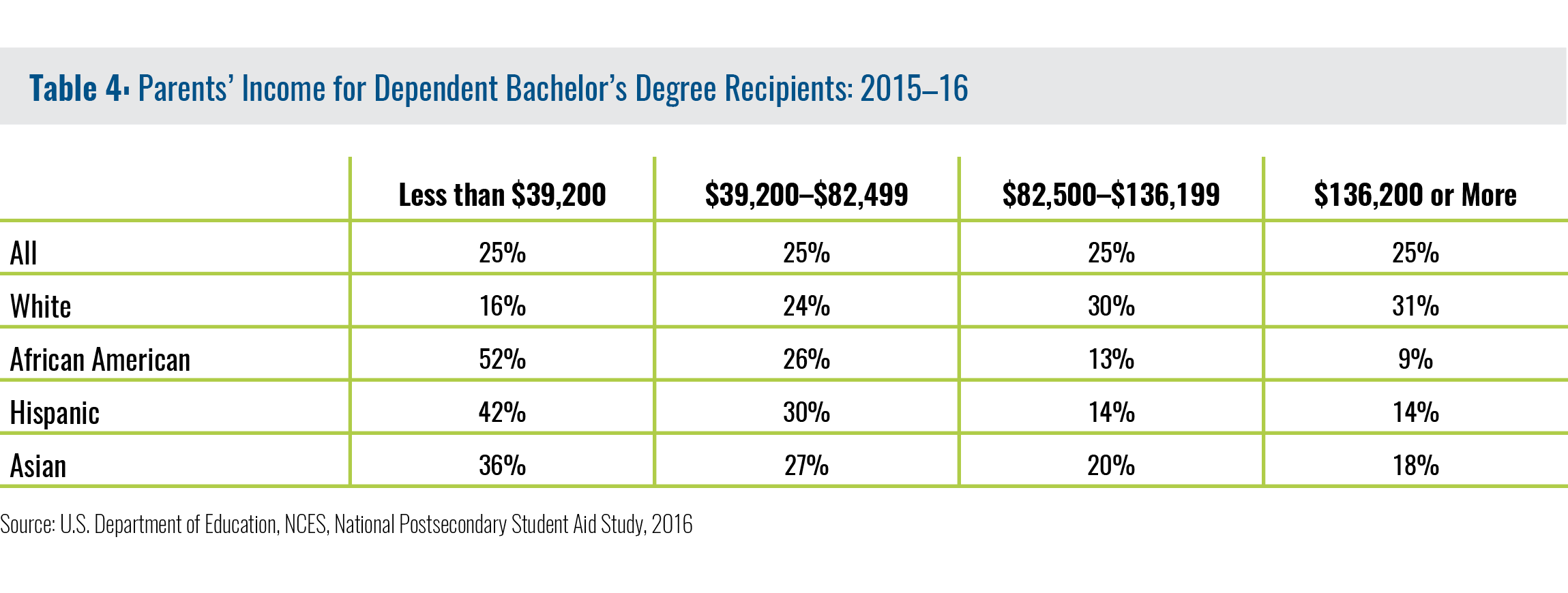

Earnings for Hispanics in both of these groups are similar to those of African Americans, and as noted, Hispanic students have lower debt levels than African American students. However, the family income levels of African American undergraduates are lower than those of Hispanic students. More than half of 2015–16 African American bachelor’s degree recipients were from the lowest income quartile of students completing these degrees. Only 9 percent came from the top quartile, with parent incomes of $136,200 or higher. In contrast, 42 percent of Hispanic graduates were from the lowest family income quartile; 14 percent of Hispanic graduates, 18 percent of Asian graduates, and 31 percent of white graduates came from the highest- income families (Table 4).

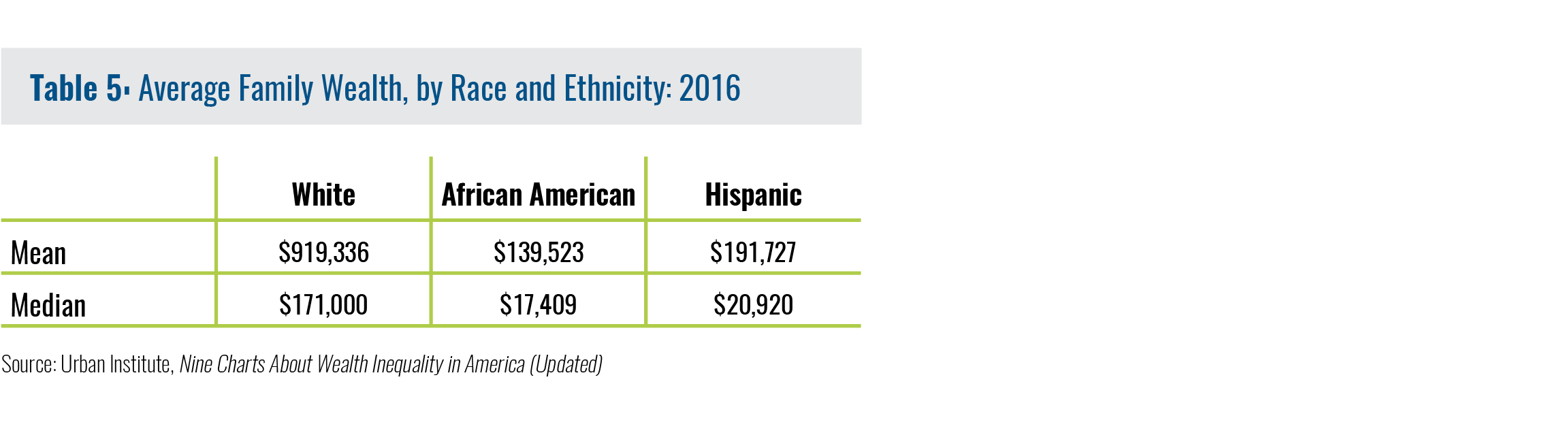

In addition to their relatively low incomes, African American families have much lower wealth than others—including Hispanic families. In 2016, the average wealth of $139,523 for African American families was 15 percent of the average for white families and 73 percent of the average for Hispanic families. The median wealth of $17,409 for African American families was 10 percent of that for white families and 83 percent of that for Hispanic families (Table 5).

The racial and ethnic wealth gap is in fact becoming wider over time, with white families experiencing growth in wealth and African American and Hispanic families experiencing declines. Between 2007 and 2016, mean wealth rose by 15 percent for white families, but declined by 11 percent for African American and Hispanic families. Median (as opposed to mean) wealth declined for all groups, but by 28 percent for African American families versus 14 percent for white and Hispanic families (McKernan et al. 2017). A long history of racial discrimination in housing policies and in access to financing explains much of the wealth gap (Jones 2017; Asante-Muhammad et al. 2017).

The resource gaps facing African American students are not only financial. In 2015–16, 34 percent of African American undergraduates (and 44 percent of Hispanic undergraduates) came from families where neither parent had any college experience. This was the case for 22 percent of white and 30 percent of Asian undergraduates. About a third of African American and Hispanic undergraduates had at least one parent with a bachelor’s degree or higher, compared with 52 percent of white and 49 percent of Asian undergraduates.[1]

In sum, on average African American students come to college with less family income and wealth and less social capital than others. In addition to these financial strains and lack of family experience with higher education, many African American students have had limited educational opportunities in elementary and secondary school.

Academic Preparation

Many African American and Hispanic students attend elementary and secondary schools with relatively low instructional resources and come to college less prepared for its academic demands than others. Scholars have attributed these differential secondary experiences to a variety of factors, including school resources, teacher attitudes, school segregation, and family and community environments (Rouse and Barrow 2006; Jencks and Phillips 1998).

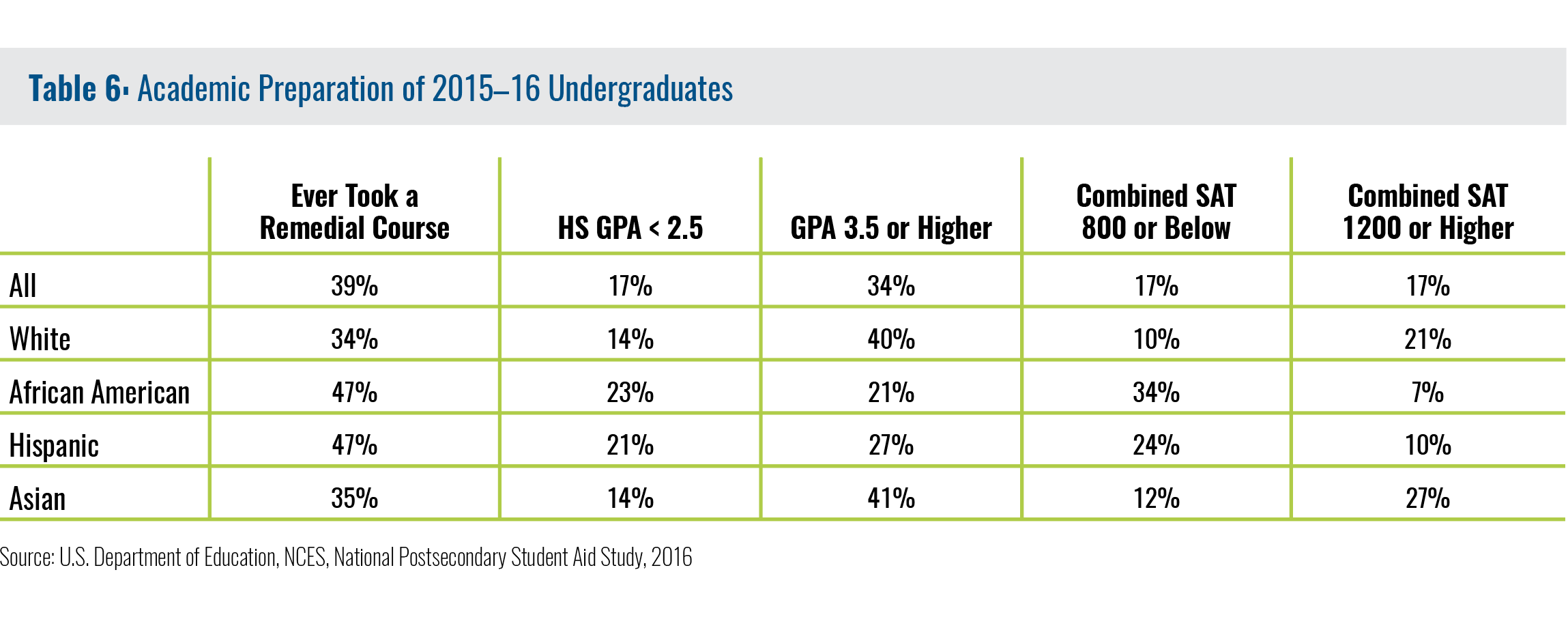

As a result of these realities and other differences in circumstances, in 2015–16 almost one-quarter of African American undergraduates had high school GPAs below 2.5, compared with 17 percent of all undergraduates. And one-third of African American students scored 800 or lower on the combined SAT, compared with 17 percent of students overall (Table 6). Limited access to advanced coursework in high school, combined with the more fundamental gaps in pre-college opportunities, make it unsurprising that African American students enroll in developmental education at high rates (College Board 2014). Overall, 39 percent of 2015–16 undergraduate students had taken at least one developmental education course, compared with 47 percent of African American and Hispanic students. These courses do not carry academic credit that counts toward a degree, although students do have to pay tuition for them, resulting in a higher overall cost of college.

The academic profiles of African American students, combined with their financial circumstances and insufficient access to good information about higher education limit their access to selective colleges and universities, which have more ample resources and better outcomes than other institutions.

Enrollment Patterns

College-going patterns exacerbate high debt levels for African American students. As noted above, African Americans are more likely than others to enroll in for-profit institutions, where tuition prices are higher than at public colleges and universities. In addition, 30 percent of African American graduates were age 30 or older when they completed their degrees, com- pared with 18 percent overall and 19 percent of Hispanic graduates. Older students borrow more and have lower completion rates than younger students. Twenty-nine percent of African American graduates had dependents of their own, and thus greater financial commitments, compared with 18 percent overall and 19 percent of Hispanic graduates. And only 42 percent of African American graduates completed their degrees within five years of first enrolling, compared with 57 percent overall and 51 percent of Hispanic graduates (Table 7). All of these circumstances are associated with higher levels of borrowing and are likely contributors to the differences between debt levels of African Americans and other students.

After College

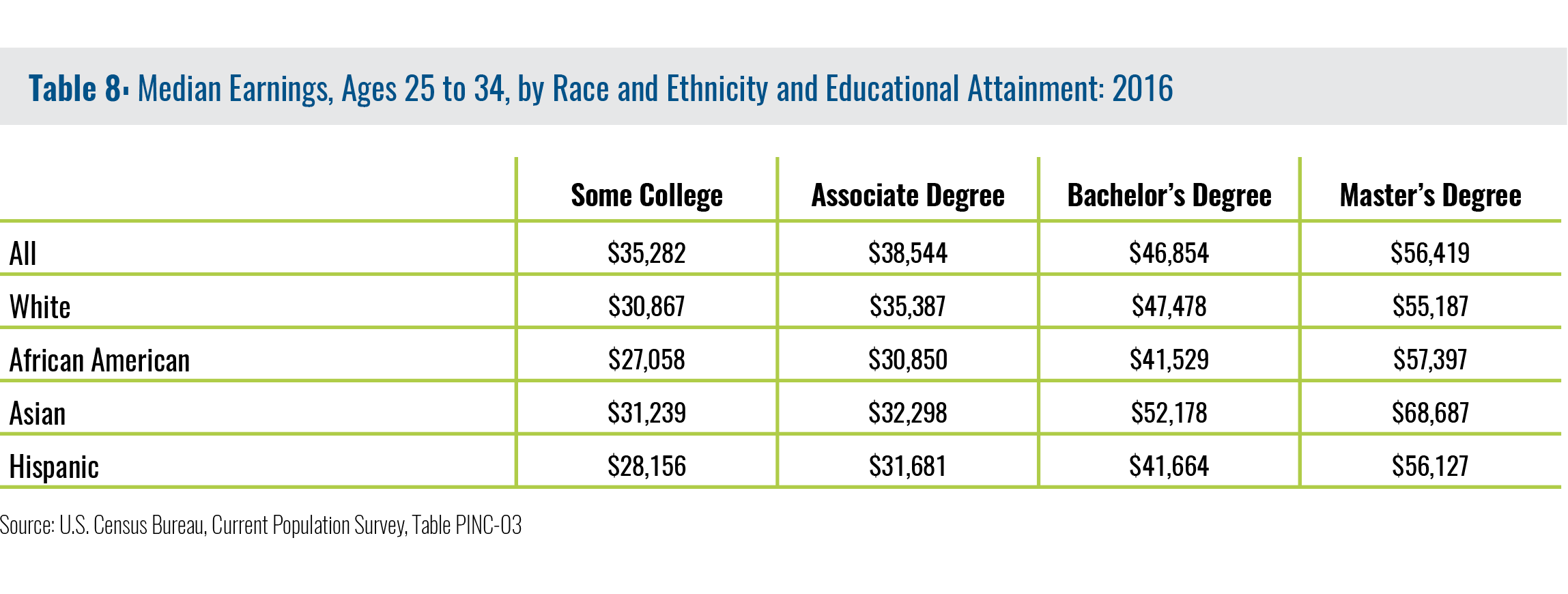

Given their higher debt levels, African American students would have more difficulty than others repaying their loans even if their post-college earnings were similar. But African American (and Hispanic) adults between the ages of 25 and 34 have lower earnings than white and Asian adults with the same level of educational attainment—further exacerbating an already uphill climb to student loan repayment. For example, median earnings for bachelor’s degree recipients in 2016 were $41,529 for African American young adults, $41,664 for Hispanics, and $47,478 for white adults in this age range (Table 8).

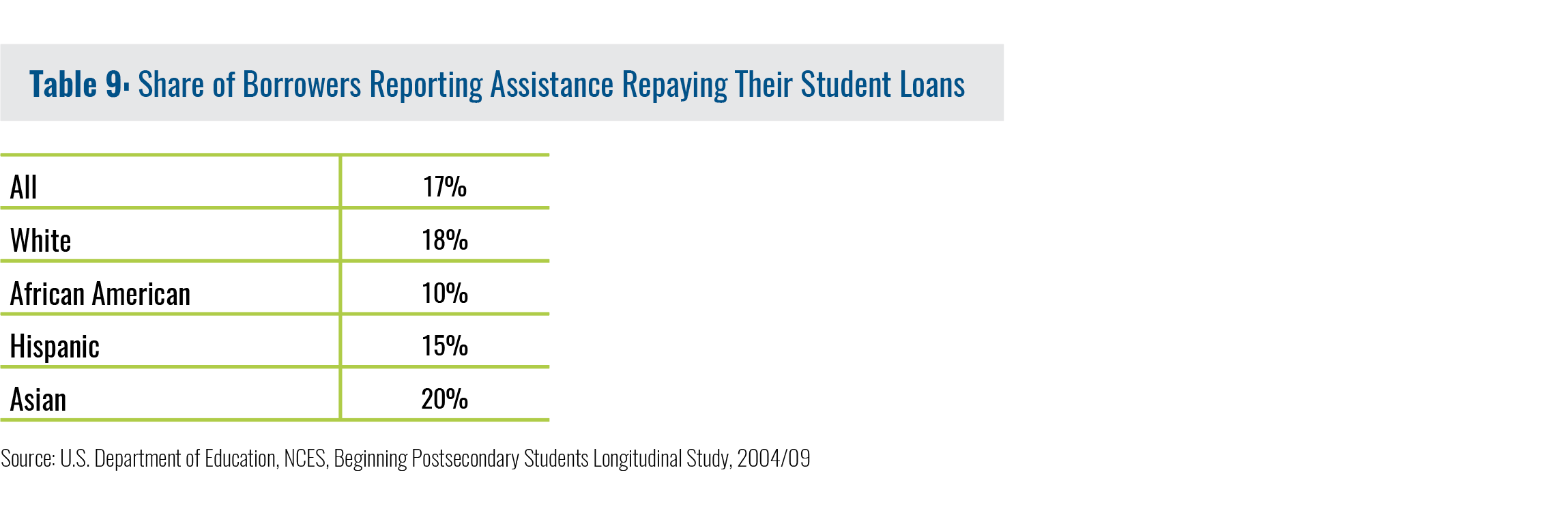

In addition to having lower earnings than their peers, African American borrowers in repayment on their student loans are less likely than others to have assistance from parents or others in repaying their loans. Among students who began college in 2003–04, the range of borrowers saying after they left school that they had help repaying their loans was from 10 percent among African American borrowers to 20 percent among Asian borrowers (Table 9).

Repayment

The release of new data from the U.S. Department of Education has recently focused attention on the repayment patterns of African American borrowers. Given their debt levels and limited access to resources before, during, and after college, it is not surprising that they struggle more with student debt. But the findings are, nonetheless, startling. The data reveal that 12 years after they first enrolled in 2003–04, about half of African American borrowers had defaulted on at least one federal loan and more than half of the borrowers in this group owed more than they originally borrowed. This was not the case for other borrowers—including Hispanic borrowers (Miller 2017).

Controlling for family background eliminates about half of the difference in default rates between Black and white borrowers. But even accounting for differences in degree attainment, college GPA, and post-college income and employment cannot fully explain the Black-white difference in default rates (Scott-Clayton 2018). Solving this problem and alleviating the challenges facing these students is critical to achieving the nation’s goals for a successful postsecondary system.

Of particular concern is that even African American bachelor’s degree recipients appear to be having difficulty repaying their loans. The median amount owed by this group 12 years after starting college was 114 percent of the amount borrowed, compared with 47 percent for white graduates, 79 percent for Hispanic graduates, and 80 percent for those from low-income households, as measured by having received a federal Pell Grant (Scott-Clayton 2018).

Conclusion

Student debt is more of a burden for African American students than for others. The financial resources available to them before, during, and after college are very limited. They are more likely than others to have attended elementary and secondary schools that did not prepare them well for college-level work and they come disproportionately from families without college experience. Other underrepresented groups, such as Hispanic students, face some but not all of the same barriers.

These circumstances, combined with the institutions in which they enroll and the timing of their postsecondary education, likely all contribute to the fact that African American students tend to accrue more debt than those from other racial and ethnic groups—including other underrepresented minority groups—earning similar degrees. The barriers that African American students face in repaying their loans are at least partially the result of the difficulty they have completing their studies, their own post-college earnings, and the limited resources of their families of origin. Further research should improve our under- standing of how all the circumstances facing African American students contribute to their unique struggles with student debt. Improved understanding of these distinct factors and how they interact should make it possible for educators and policymakers to better target solutions that can reverse these trends.

Failure to address these problems threatens the potential for college education to improve the lives of young African Americans. Solutions should not ignore the role of access to loans in making college a realistic possibility for students lacking family resources. Among 2003–04 beginning college students, 10 percent of African American students reported being able to start college sooner because of loans—more than in any other group.[2] Providing more grant funding, better guidance in choosing postsecondary paths, and stronger supports while students are in college has the potential to mitigate some of the difficulties facing African American students. Over the longer run, only diminishing disparities in pre-college and post-college circumstances can put African American students on a more level playing field with their peers.

References

Asante-Muhammad, Dedrick, Chuck Collins, Josh Hoxie, and Emanuel Nieves. 2017.The Road to Zero Wealth: How the Racial Wealth Divide is Hollowing Out America’s Middle Class. Washington, DC: Institute for Policy Studies and Prosperity Now. https://prosperitynow.org/resources/road-zero-wealth.

College Board. 2014. 10th Annual AP Report to the Nation http://media.collegeboard.com/digitalServices/pdf/ap/rtn/10th-annual/10th-annual-ap-report-to-the-nation-single-page.pdf.

Jencks, Christopher, and Meredith Phillips, eds. 1998. The Black-White Test Score Gap. Washington, DC: Brookings Institution Press.

Jones, Janelle Jones. 2017. “The Racial Wealth Gap: How African-Americans Have Been Shortchanged out of the Materials to Build Wealth.” Working Economics Blog, Economic Policy Institute. February 13, 2017. https://www.epi.org/blog/the- racial-wealth-gap-how-african-americans-have-been-shortchanged-out-of-the-materials-to-build-wealth.

McKernan, Signe-Mary, Caroline Ratcliffe, C. Eugene Steuerle, Caleb Quakenbush, and Emma Kalish. 2017. Nine Charts About Wealth Inequality in America (Updated). Urban Institute. http://apps.urban.org/features/wealth-inequality-charts.

Miller, Ben. 2017. “New Federal Data Show a Student Loan Crisis for African American Borrowers.” Center for American Progress, October 16, 2017. https://www.americanprogress.org/issues/education-postsecondary/news/2017/10/16/440711.

Rouse, Cecilia Elena, and Lisa Barrow. 2006. “U.S. Elementary and Secondary Schools: Equalizing Opportunity or Replicating the Status Quo?” The Future of Children 16 (2): 99–123.

Scott-Clayton, Judith. 2018. “What Accounts for Differences in Student Loan Default, and What Happens After.” Evidence Speaks, Brookings. June 21, 2018. https://www.brookings.edu/research/what-accounts-for-gaps-in-student-loan-default-and-what-happens-after.

U.S. Census Bureau. 2016. Current Population Survey.

[1] U.S. Department of Education, National Center for Education Statistics, National Postsecondary Student Aid Study, 2016, PowerStats, author’s calculations.

[2] U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students Longitudinal Study, 2004/09, PowerStats, author’s calculations.